Estimated Tax Payments 2025 Forms Vouchers. As such, it is possible to underestimate, resulting in an underpayment and penalty. March 5, 2025 10:20 am.

How to use the irs estimated tax worksheet to calculate your tax bill throughout the year; If your turbotax navigation looks different from what’s described here, learn more.

This interview will help you determine if you’re required to make estimated tax payments for 2025 or if you meet an exception.

Estimated Tax Forms For 2025 Perry Brigitta, The first line of the address should be internal revenue service center. March 5, 2025 10:20 am.

Estimated Tax Payments 2025 Overview and When To Pay, These deadlines are crucial to avoid penalties. Generally, your estimated tax must be paid in full on or before april 15, 2025, or in equal installments on or before april 15, 2025;

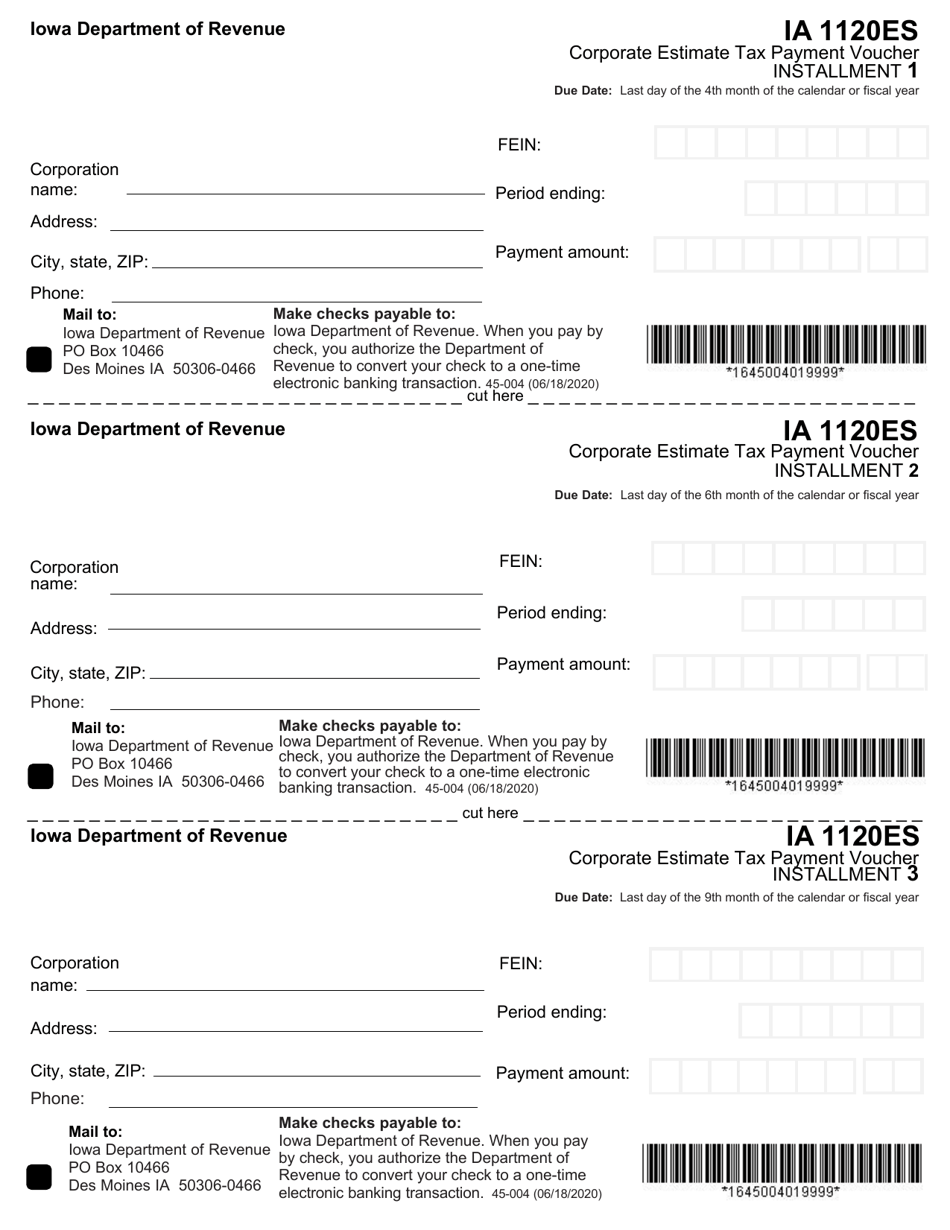

Form IA1120ES (45004) Fill Out, Sign Online and Download Fillable, If your name, address, or ssn is incorrect, see instructions. To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2025.

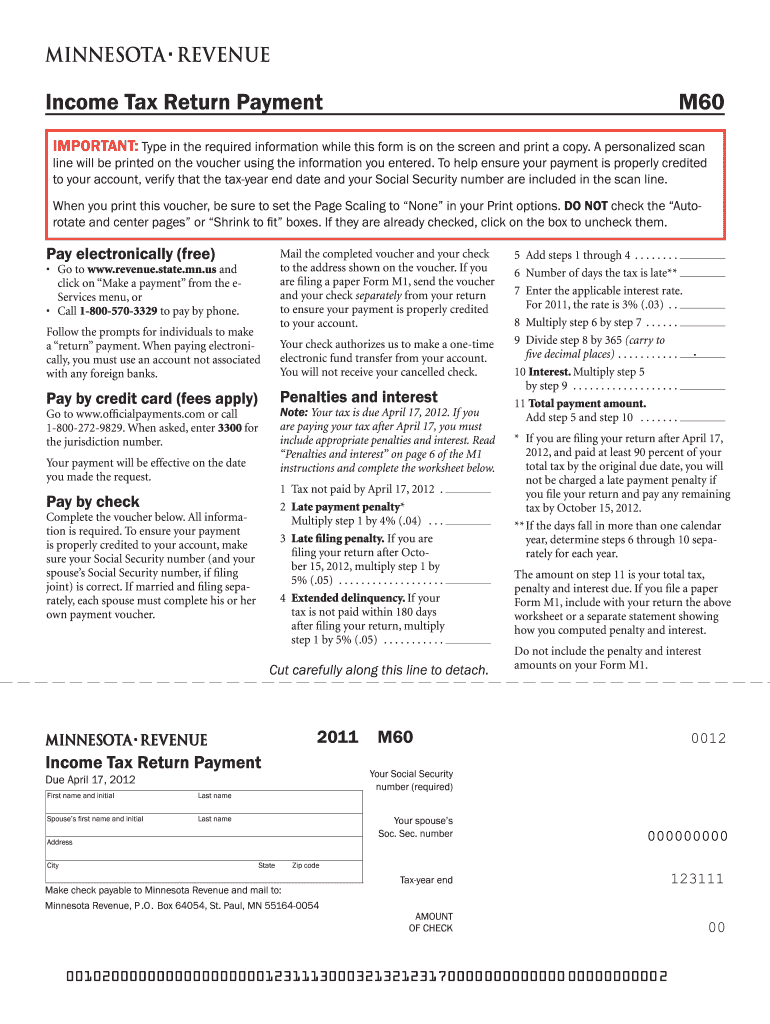

Mn Estimated Tax Complete with ease airSlate SignNow, To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2025. To pay electronically and for more information on other payment options, visit irs.gov/payments.

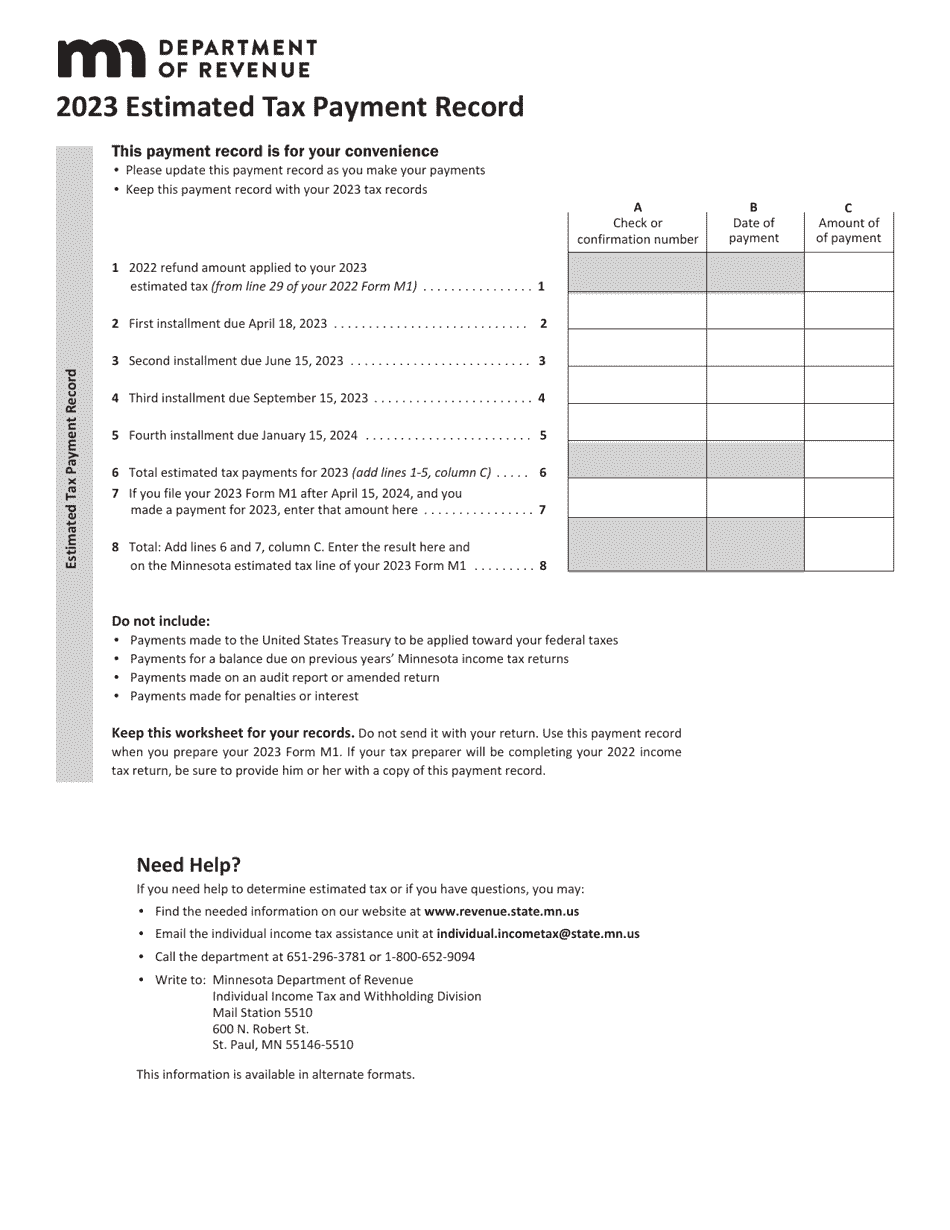

2025 Minnesota Estimated Tax Payment Record Fill Out, Sign Online and, Sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax payment system (eftps) enrollment required to use this option. We do this to head off a possible underpayment penalty on next year's taxes.

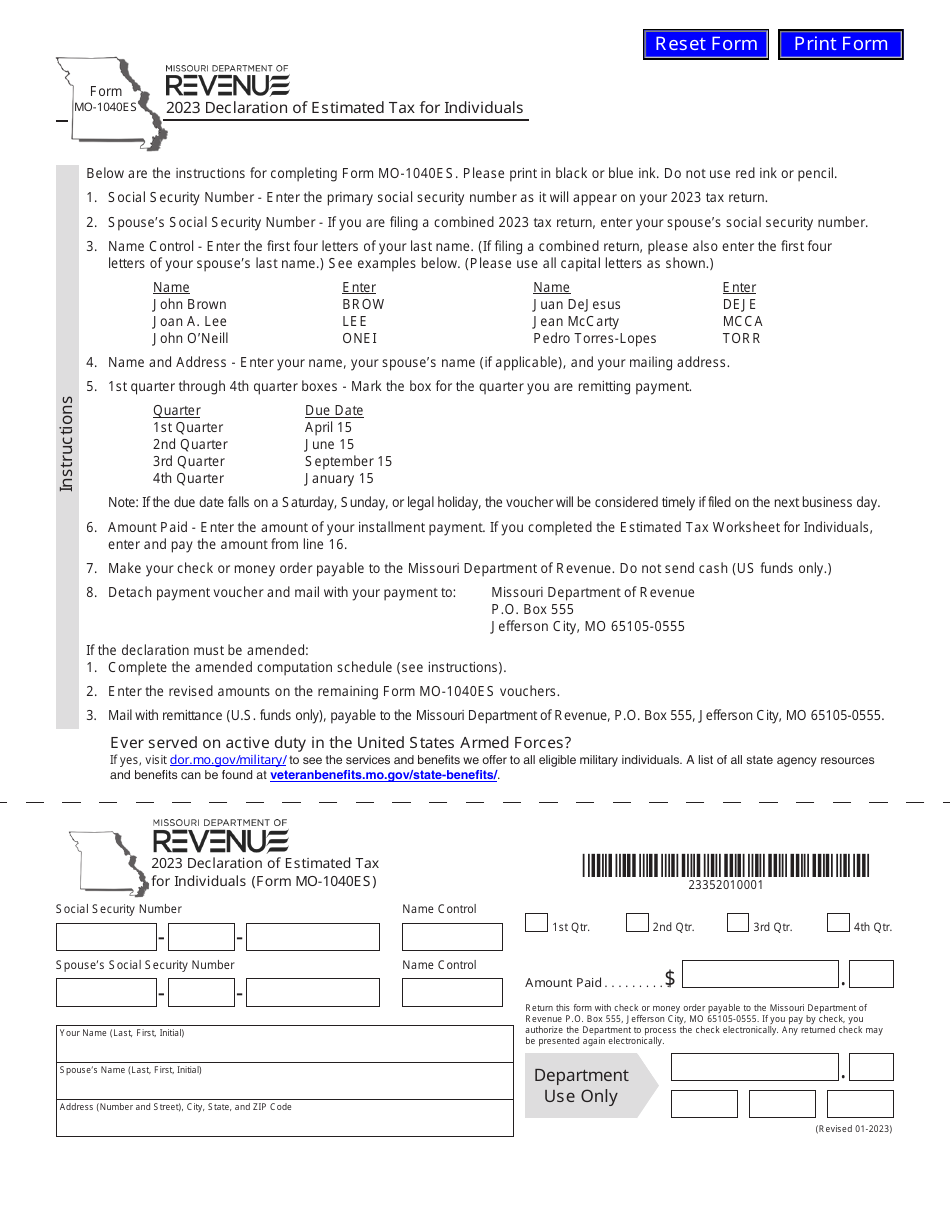

Form MO1040ES Download Fillable PDF or Fill Online Declaration of, To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2025. Paying by check or money order.

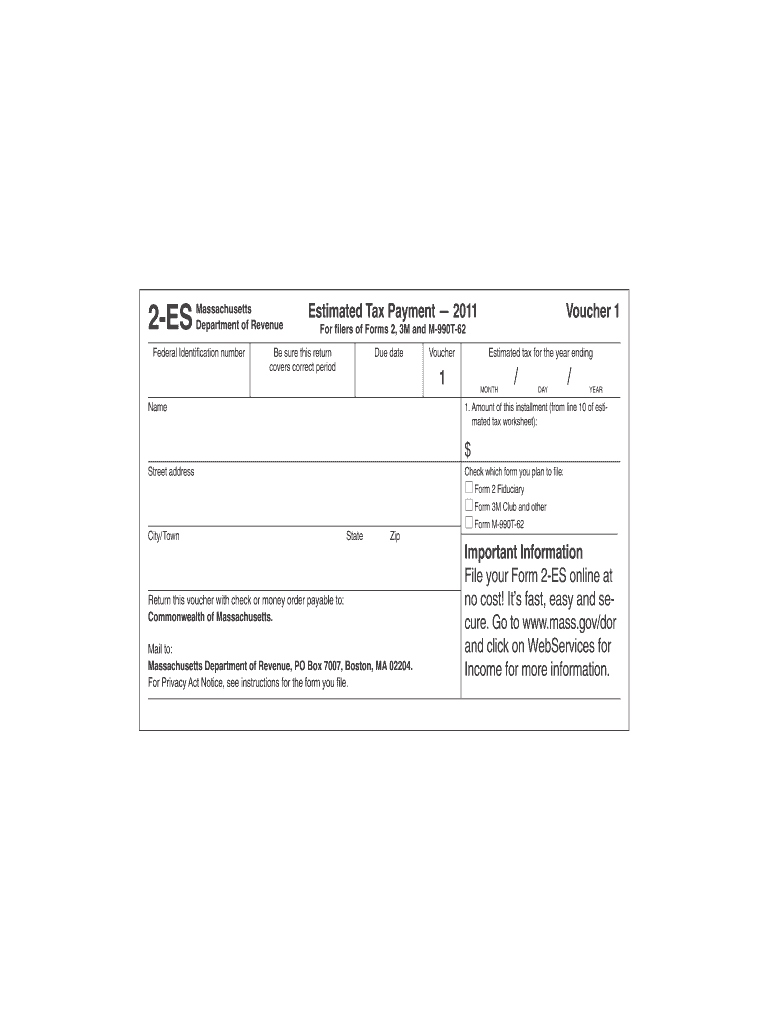

Estimated Tax Payment Voucher 1 1 Important Information Mass Fill, Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding. To avoid this penalty, you can use your previous year’s taxes as a guide.

Estimated Tax Payments 2025 Address Hetty Philippe, Solved•by turbotax•4644•updated december 11, 2025. Solved•by turbotax•2193•updated january 30, 2025.

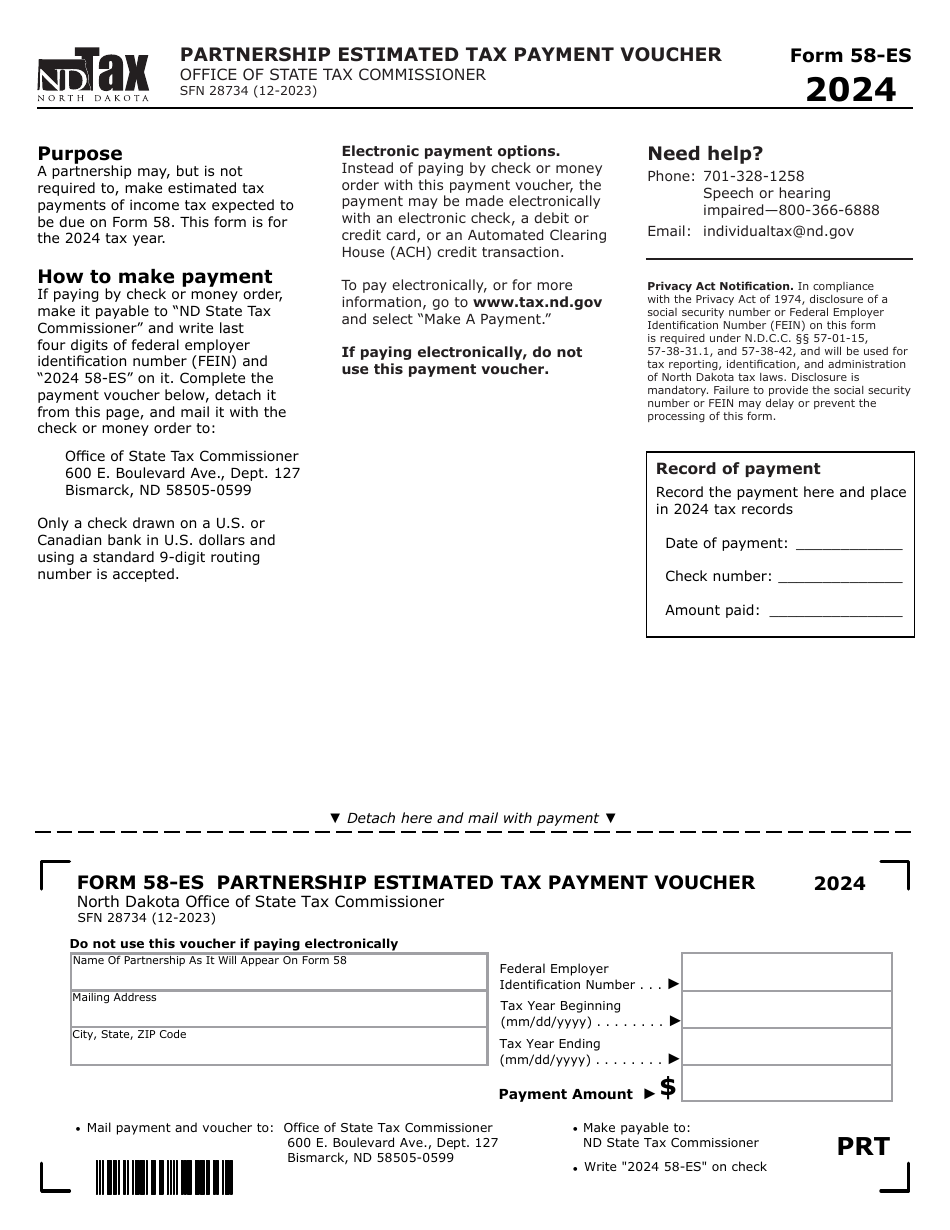

Form 58ES (SFN28734) Download Fillable PDF or Fill Online Partnership, Solved•by turbotax•2448•updated april 02, 2025. The importance of adhering to these dates.

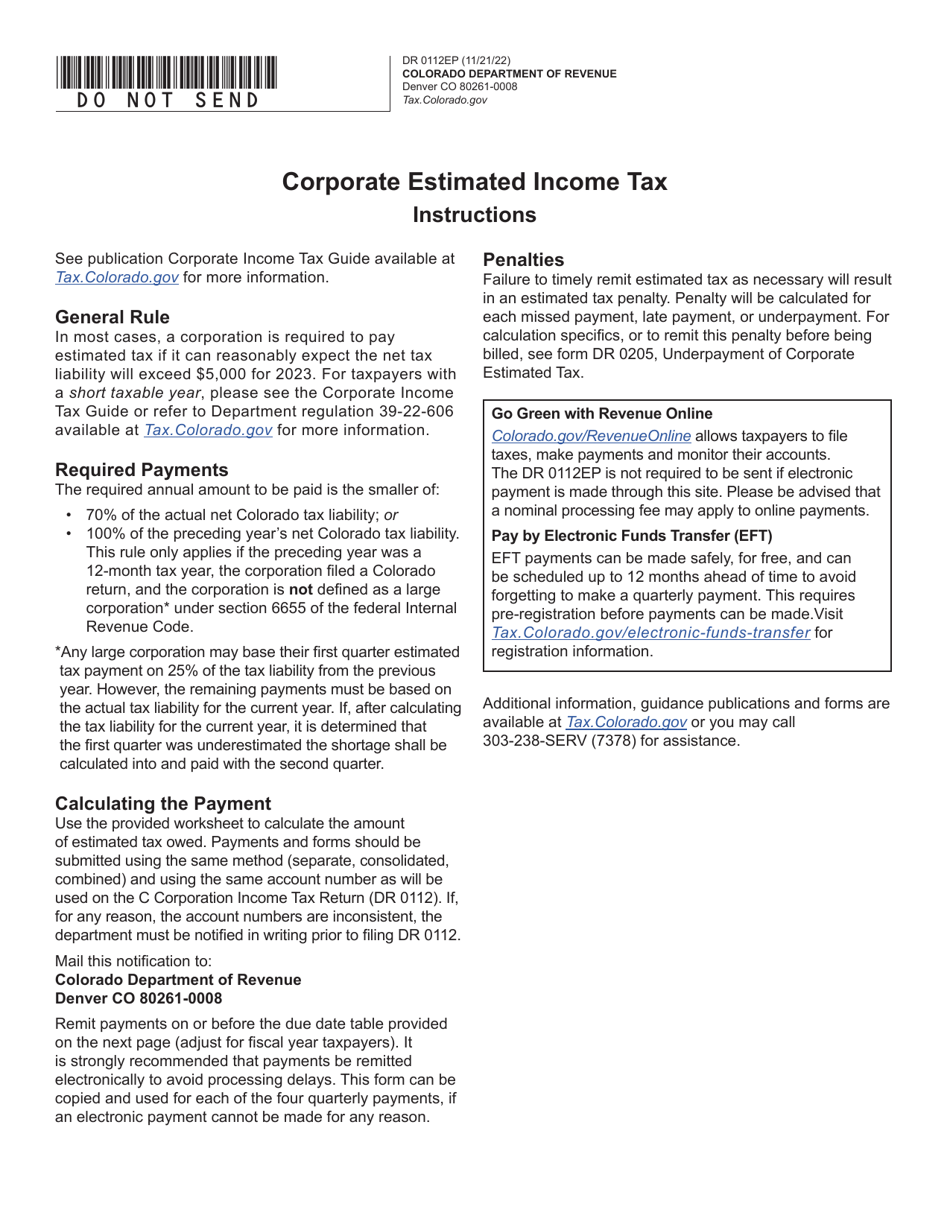

Form DR0112EP Download Fillable PDF or Fill Online Corporate Estimated, Final payment due in january 2025. Generally, your estimated tax must be paid in full on or before april 15, 2025, or in equal installments on or before april 15, 2025;